It’s commonly believed that the human resource department and finance departments struggle to speak the same language and function together. HR may be more focused on increasing the effectiveness of its employees while the finance department may focus on profitability (viewing HR as an additional cost). While there may be friction between these two departments, a strong relationship between human resources and finance departments can lead to business success.

If you could build a hiring plan tailored to the real revenue and growth plans of your company, this could achieve a higher level of performance and profitability. That’s a win-win situation for all.

Here are some things to consider:

- How long does it really take for employees (e.g. sales executives) to ramp up and help the company become more profitable?

- Is the company over or under paying for benefits?

- How do you read a balance sheet?

- What’s P&L?

- What’s a cash flow statement?

This is exactly what Joe Silver, SVP of Finance at Lighter Capital, discussed at the May Seattle HR Collective Meetup joined by Mikaela Kiner and Jennie Ellis.

Three Financial Statements

Knowing how a company makes money can help you become a true partner to other business leaders. Joe called out 3 primary segments when it comes to understanding financial statements: a balance sheet, income statement (P&L) and cash flow statement.

Balance Sheet

A balance sheet includes assets (what a company owns), liabilities (what a company owes) and equity (value of shareholders’ investment).

- Current Assets – Can be turned into cash < 1 year

- Cash = Cash

- Accounts Receivable = What you’re owed

- Inventory = Raw materials, items bought to be resold

- Long Term Assets – Can’t be easily liquidated

- Property, Plant and Equipment = Tangible fixed assets

- Goodwill = Intangible value (purchase price less market value from M&A transaction)

- Current Liabilities – Payable in < 1 year

- Notes Payable = Short-term debt obligations (line of credit, current portion of long term debt)

- Accounts Payable = Cash owed to vendors, suppliers, etc.

- Long-Term Liabilities – Payable in > 1 year

- Long-Term Debt = Debt obligations due in > 1 year

- Equity

- Stock (common, preferred) = Ownership interests

- Retained Earnings /(loss)= Earnings retained and reinvested in business (vs paid out in dividends)

Now that you have the terminology, there are several keys to analysis. A balance sheet only captures a snapshot in time. To better understand how a company is performing, there are several ways to analyze balance sheets.

- Trends between points in time

- Cash last year vs. cash today

- Accounts receivable last quarter vs. accounts receivable today

- Rations between categories

- Current assets vs. current liabilities

- Debt to equity

- Absolute amounts relative to targets/thresholds

- Minimum liquidity

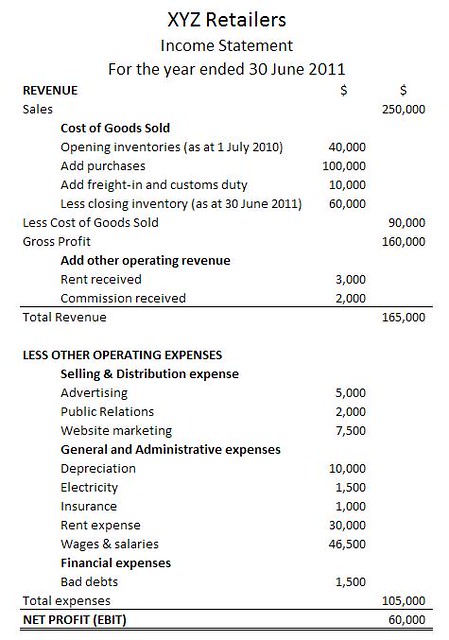

Income Statement (aka P&L)

An income statement is a periodic summary of a company’s financial performance (earnings). In order to stay in business, all companies need to generate revenue. The income statement includes revenue, operating income and net income. The income statement is also known as the profit and loss statement (P&L).

Some things to consider: how scalable is the business? Is the company eating cash? Does it take a lot of money to create the product or service?

- Revenue – Inflows from sales of products or services

- Cost of Revenue (COGS) = Costs directly tied to generating revenue

- Gross Profit = Revenue – COGS

- Operating Expenses = All expenses not directly tied to generating revenue

- Operating Income (EBITDA) – Gross Profit – OpEx

- Non-operating Expenses = Interest, Tax, “Other”

- Net Income = Operating Income – Non-operating Expenses

To better analyze an income statement, there are several keys to analysis.

- Trends over time periods

- This month’s revenue vs last month/prior year

- Components of revenue over time (diversification of products, services)

- Ratios between categories

- Margins – expenses vs revenue

- Revenue per employee

- Absolute amounts relative to budget

- Revenue vs budget

- Expenses vs budget

Cash Flow Statement

A cash flow statement is a periodic summary of change in cash that’s entering and leaving a company. It also reconciles profit & loss (P&L) to the balance sheet. The cash flow statement (CFS) measures how a company manages its cash in order to pay its debt obligations and operating expenses.

To better analyze a cash flow statement, review the following:

- Translate balance sheet & P&L

- Profitable vs. cash flow positive

- Cash burn

- How cash was generated over time

- Financing activities

- New debt or new equity?

Some Additional HR Considerations

Now that you have an understanding of the three financial statements, there are numerous things to consider when HR and finance departments work together.

- What are direct employee expenses? This includes products, department or project (e.g. software, equipment, and labor)

- Don’t just take a look at the P&L but also understand what’s generating revenue that investor’s care about

In addition, try to understand how long it’ll take to ramp up employees. Quotas can take time. It may take a sales account executive several months to train and start contributing to the company’s bottom line. Understand what a productive person may look like (take the average). Don’t set a quota by the top performer to keep revenue gains more realistic.

- Perform a relevant cost analysis

- Employee expenses vs overhead

- Gross revenue per employee or profit per employee

- Plan ramp-up of employees

- Cash hit now, revenue gains later

- Importance of delayed/progress payments

- Timing of expenditures

- Within HR and other team’s sensitivities

- Importance of contract flexibility

Thanks to Joe for presenting at the May Seattle HR Collective Meetup!